Earlier this week, Substratum CEO Justin Tabb made an update video sharing details about the SUB token swap and smart contract update. Near the end of the video, Tabb discusses Substratum’s stance on treasury management. Specifically, Tabb revealed that an in-house trader will be using ETH raised from Substratum’s ICO to conduct trades with the goal of increasing the firm’s ETH holdings. To my knowledge, this move is unprecedented in the sense that no other ICO-funded project has publicly acknowledged the trading of ICO funds on unregulated exchanges. Before we get into the implications and of this announcement, here is Justin Tabb’s statement.

There were some questions regarding a few months ago, or maybe a month and a half ago, we did a cash in of 1,000 Ethereum. People wondered why we did that. Well, it was based off our simulations. Uh, we have a full-time trader staff now for Amplify and basically his Monte Carlo simulations — 1,000 simulations indicated that Ethereum was at least going to test 60. It was prudent to cash in over $200 — the 1,000 Ethereum that we needed and we’ve done that, and that’s been a very wise move obviously. Um, so we’ll just throw it all in this video.

Um, so basically what’s happening now is that those simulations continued to indicate that Ethereum is going to continue its downward trend, obviously, and test all the way down to $60. So, we are going to not cash in, but begin basically attempting to trade up so we can further out position as long as possible. Obviously this bear market is hard on everybody. We’ve made the long bet on cryptocurrency which worked out very well for us. You know, we did a lot of cash ins above $1,200, at $1,200, above $1000. Uh, and so, but when when our ICO price was $225 to $250 in Ethereum, and now you’re talking about $60, it obviously cuts your time by 75%.

So we’re taking advantage of the trader that we have in full-time, and we are going to be actively trading a portion of the Ethereum so that we can trade up basically. So we can sell at the top of the bands, and buy at the bottom of the bands. And actually we’re not doing anything that’s different from what’s in our whitepaper cause we’re not doing anything other than trading it off the USDT, and that’s in the whitepaper, the original whitepaper — you can take a look. So, we will be actively doing that and you can actually watch that happen, but it’s just to further our position, so we should be able to pick a percentage of Ethereum when we re-buy in, and then once the market turns back bull, which I believe it will in a couple months, then our position will be that much better and we’ll be able to further the time that we have to continue building the products that we want to build until we get cash flow positive, which we expect to do next year.

Now, let’s break down and analyze Justin Tabb’s statements because some make sense, some don’t, and others are just outright lies.

Monte Carlo Simulations

Monte Carlo simulations or experiments are computational algorithms that use repetitive random sampling to generate a numerical result. This method of problem-solving is often used in scenarios with variables that have multiple degrees of freedom. I won’t get too deep into how these algorithms work, but what I can say is that in the context of this video, Justin Tabb’s casual mention of Monte Carlo simulations suggests he does not know what he’s talking about. Without defining the biases and guidelines that derived the simulation’s input domain, Tabb’s statement regarding using Monte Carlo simulations to predict the price of ETH is simply meaningless.

Well, it was based off our simulations. Uh, we have a full-time trader staff now for Amplify and basically his Monte Carlo simulations – 1,000 simulations indicated that Ethereum was at least going to test 60.

As you can see, Tabb makes no mention of the psychological biases, technical indicators, and the process of aggregating and quantifying both micro and macroeconomic factors behind the construction of the simulation’s test domain. Without this information, Tabb’s “1,000 simulations” is just another example of Substratum using advanced terminology to dupe investors.

The Whitepaper Argument

In the video, Justin Tabb states the following.

So we’re taking advantage of the trader that we have in full-time, and we are going to be actively trading a portion of the Ethereum so that we can trade up basically. So we can sell at the top of the bands, and buy at the bottom of the bands. And actually we’re not doing anything that’s different from what’s in our whitepaper cause we’re not doing anything other than trading it off the USDT, and that’s in the whitepaper, the original whitepaper — you can take a look.

I’ve questioned Tabb’s integrity in the past, but this quote seals the deal because it’s an outrageous lie. There’s just no other way to interpret this, and it confirms my suspicion that Justin Tabb is a scammer at heart. Let me explain.

Substratum’s plan to hedge its ICO funding into BTC, ETH, USDT, and USD in 25% portions is not in the original whitepaper from August 2017. It’s in the second version of the whitepaper from December 2017. Here’s what the whitepaper states regarding hedging ICO funding.

To ensure the development fund is not subject to big market fluctuations, we’re hedging it four ways. By doing this we ensure we have the capital needed to finish each phase of the project budgeted for in the Initial Coin Offering (ICO). Ethereum (25%) BitCoin (25%) USDT (25%) USD Fiat (25%).

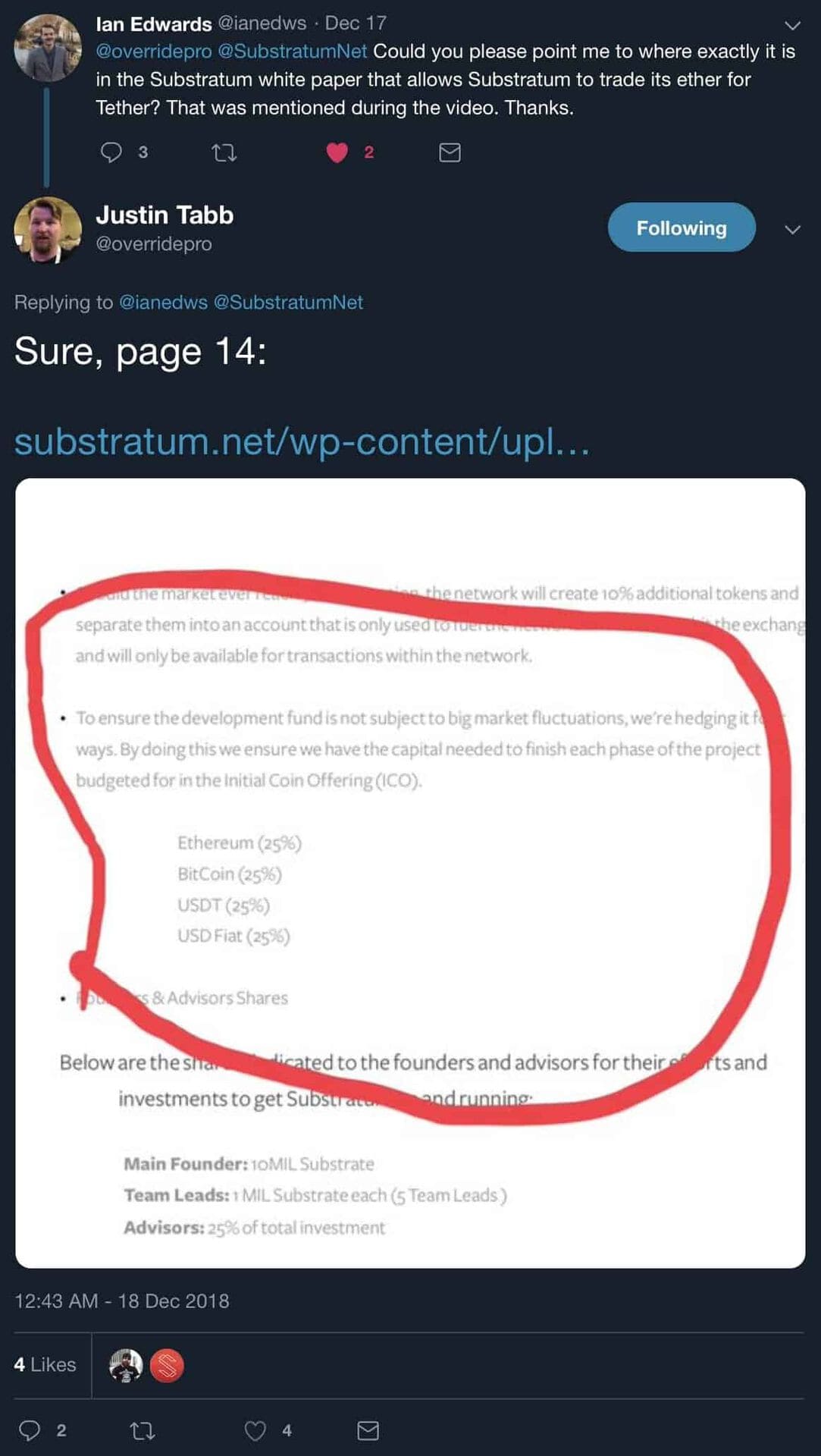

First of all, it’s hilarious that a cryptocurrency startup that raised over $13 million managed to misspell “Bitcoin”. Secondly, the whitepaper makes no mention of Substratum using investor-contributed ETH to trade on a secondary market like Binance. Still, Justin Tabb felt the need to justify his actions and responded to a tweet from Ian Edwards that reads as follows.

@overridepro @SubstratumNet Could you please point me to where exactly it is in the Substratum white paper that allows Substratum to trade its ether for Tether? That was mentioned during the video. Thanks.

In response, Justin Tabb uploaded a screenshot showing page 14 of Substratum’s V2 whitepaper with a poorly drawn red circle around the supposed section of the whitepaper that grants Substratum the right to gamble with investor funds on unregulated markets.

Again, here’s the section of the whitepaper in question.

To ensure the development fund is nsot subject to big market fluctuations, we’re hedging it four ways. By doing this we ensure we have the capital needed to finish each phase of the project budgeted for in the Initial Coin Offering (ICO). Ethereum (25%) BitCoin (25%) USDT (25%) USD Fiat (25%).

The bolded sentence is by far the most important part of this statement because it provides investors with the reason behind Substratum’s proposed hedging model, and that reason is to ensure the company has enough funding to fulfill its business plan. In other words, 50% of funds are hedged into stable currencies with the intent of cashing out strictly for business development (to finish each phase of the project) on a one hop basis (funding -> business milestones). By giving up control of investor funds to a full-time trader, Substratum is introducing an extra hop between the funding and its potential use to achieve business milestones (funding -> trading/speculation -> business milestones). This is evident because Justin Tabb explicitly stated the purpose of trading investor funds is to “trade up” and “to pick a percentage of Ethereum when [they] re-buy in.” Lastly, since Substratum is fundamentally not a trading firm, they cannot ignore the extra trading/speculation hop and claim it’s the same thing as hedging into USDT or USD for business development purposes. Why? Because trading is not part of Substratum’s business plan as highlighted in its “original whitepaper”.

Conclusion

The timing of this trading announcement is very suspicious when you consider the current state of the market, Justin Tabb’s confidence in the market turning back bull “in a couple months,” and the failure of the AMPX ICO which has attracted less than $20,000 in its public sale thus far. Based on these facts, the obvious conclusion is that Substratum is in deep financial trouble and has been forced to partake in day-trading and swing-trading investor funds to stay afloat. If Tabb truly believes the market is going to reverse to the upside in the next few months, what’s the point of risking investor funds on an unregulated exchange? Does Substratum not have enough money to keep the lights on for another couple of months?

Regardless, the community should not be taking Tabb’s announcement lightly. Substratum’s hedging statement in its whitepaper is completely unrelated to trading investor-contributed ETH for the purpose of accumulating more ETH. If Substratum wishes to move forward with trading investor funds, it should release a set of trading guidelines detailing risk management protocols and investor communication — after all, Tabb stated investors will be able to “actually watch [trading] happen”. As I stated earlier, this most recent development has fully convinced me that Substratum CEO Justin Tabb is a scammer. He’s a crutch to the project, especially on the PR front, and Substratum would be much better off without a leader who thinks it’s appropriate to trade in the world’s most volatile market with investor funds.

Update (January 9, 2019) – Substratum has deleted the video from its official YouTube channel, but it has been reuploaded by a third party.